Created with the Investing and Opportunity Act, which was part of the 2017 Tax Cuts and Jobs Act, the goal behind Opportunity Zones is to stimulate the estimated $6.1 trillion of private capital gains held by U.S. households. The big idea is to drive more investors with no financial cap into communities that need them.

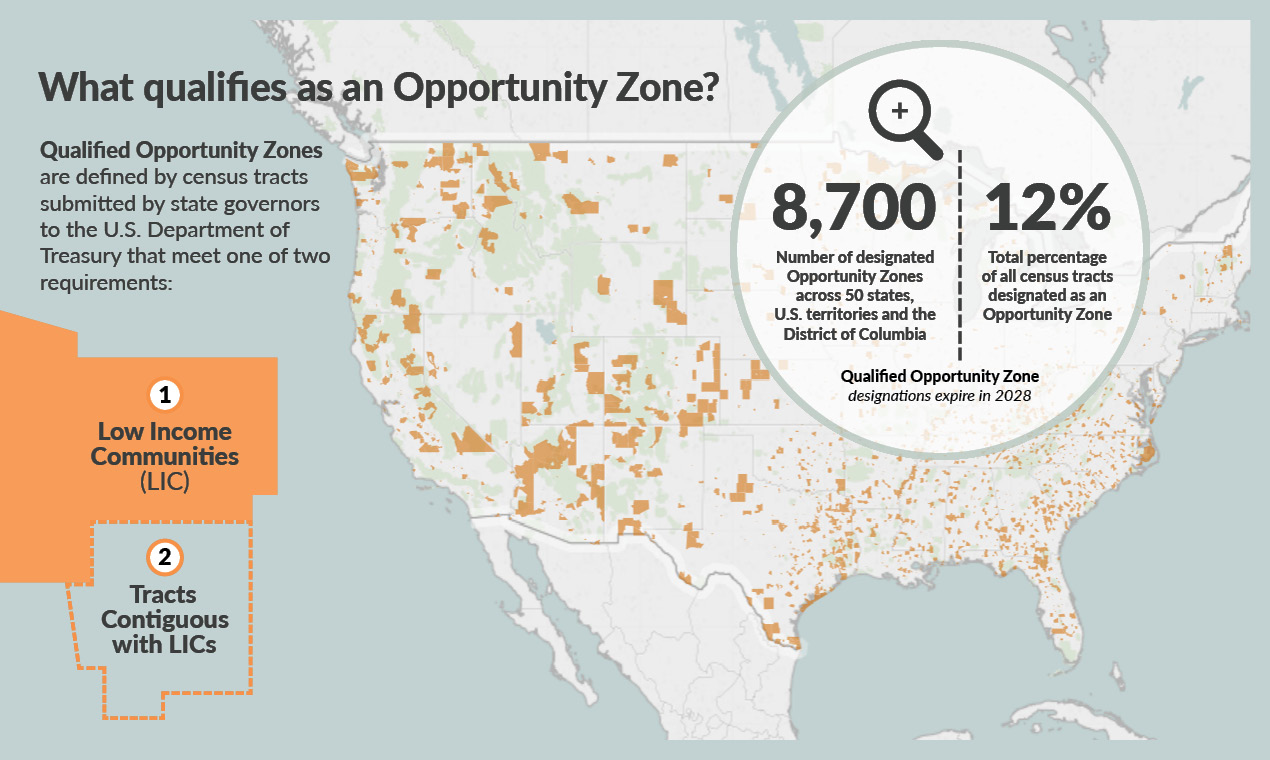

What Qualifies as an Opportunity Zone?

Qualified Opportunity Zones (QOZs) are defined by census tracts submitted by state governors to the U.S. Department of Treasury that meet one of two requirements:

1. Low Income Communities (LIC)

-- 20% poverty rate or not exceeding 80% median income

-- Each state allowed to submit 25% of their total LICs (minimum 25)

or

2. Tracts Contiguous with LICs

-- 5% of a state's total number of Qualified Opportunity Zones can be contiguous to an LIC Opportunity Zone

-- Median income cannot exceed 125% of at least one adjacent LIC Opportunity Zone

On June 14, 2018, certification was granted to the final round of Opportunity Zone nominations, bringing the total to 8,700 qualified census tracts (a total of 12% of all census tracts) across 50 states, U.S. territories, and the District of Columbia. No additional nominations are being accepted at this time, and the designation of a Qualified Opportunity Zone expires in 2028. However, a successful Opportunity Zones program may result in an extension and/or additional tracts added in the future.

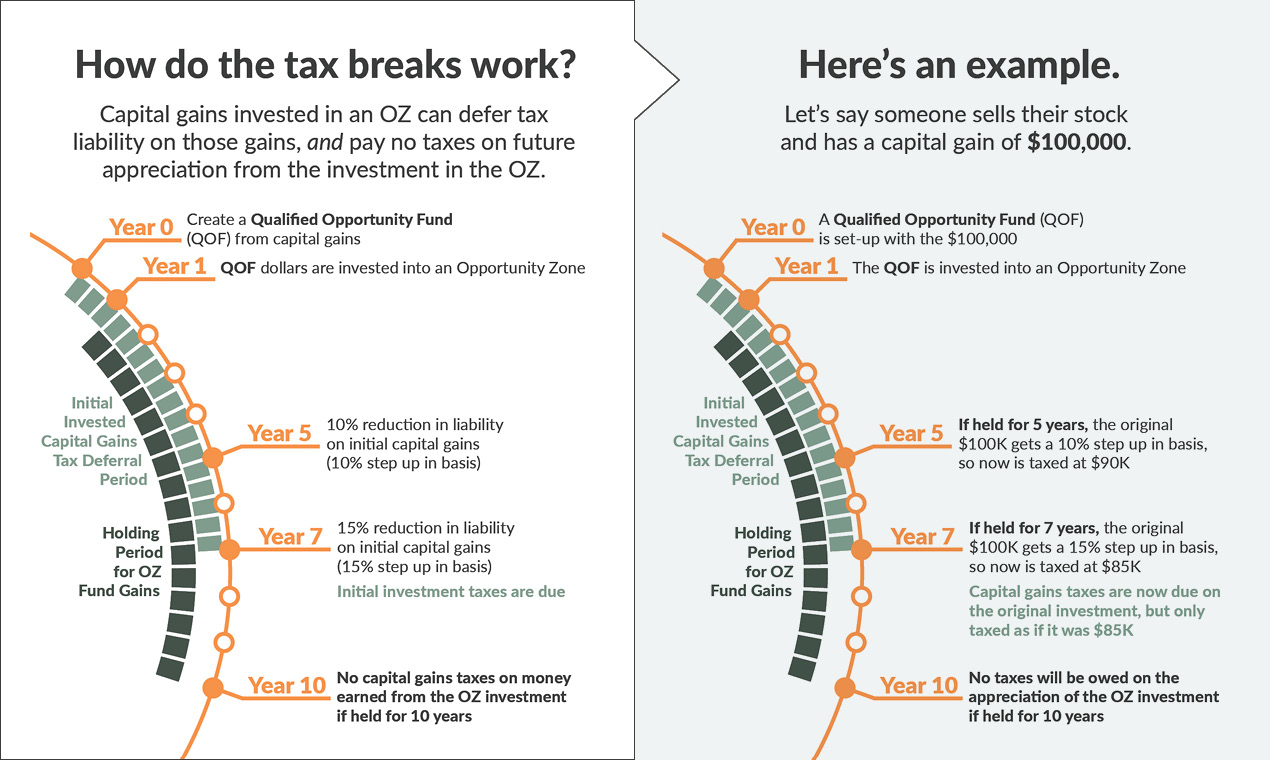

How Do the Tax Breaks Work?

Capital gains invested in a Qualified Opportunity Zone can postpone tax liability on those gains, and pay no taxes on future appreciation from the investment, by investing in a Qualified Opportunity Fund (QOF). A QOF is an investment vehicle set-up as a corporation or a partnership established to invest in eligible property qualified as an Opportunity Zone.

Navigating the Way Forward

As urban planners, designers and architects, we navigate the line between public officials and private developers on a daily basis. Our knowledge, experience and partnerships in both realms, provide a bridge to leveraging privately sourced funds for the benefit of economically-distressed communities. Initiating the dialogue and evaluating the opportunities of Qualified Opportunity Zones within their local context, is the first step, while keeping the following in mind:

Market Knowledge / Product Knowledge

-- Recognize areas that are already trending in a positive direction, with room for more growth helps reduce risk.

-- Understand how residential and commercial buildings work within a given envelope will help unlock creative solutions to making a project pencil.

Understanding Zoning Code

-- Interpret the regulations of a Zoning Code as well as how to amend such regulations as new conditions like Opportunity Zones arise.

-- Identify Corridor Plans, Downtown Plans, and District Plans as comprehensive strategies for guiding the future development of Opportunity Zones.

Capacity Studies

-- Perform quick capacity studies of Opportunity Zones to evaluate potential use and yield, as well as the impact to community value and livability.

While regulations are still being finalized, the tool and map of Qualified Opportunity Zones are in place for action to ensue. Because Opportunity Zones were determined based on 2010 census data; some tracts may have better potential than their 2010 data suggests. Working with entrepreneurs, business owners, developers, community stakeholders, and state and local leaders, DAHLIN can help develop comprehensive strategies for how economic development and community re-investment projects take shape.